By Nnanke Harry Willie

By Nnanke Harry Willie

Nothing good comes easy. This maxim is true of personal goals as it is of institutional and even national goals. It is also true of policies such as the Naira Redesign policy.

Godwin Emefiele, the Governor of the Central Bank of Nigeria is learning the hard way that managing an Executive Order towards changing the paradigm for Nigerians and their eternal bonds with ‘solid’ cash may be a bit more challenging than he may have imagined.

The Naira Redesign programme has become an albatross for the CBN Governor as he has been harangued, abused and even threatened for trying to move Nigeria perhaps too fast into the elite group of nations basking in a cashless economy and thus enjoy all the benefits of being among the early movers in this direction.

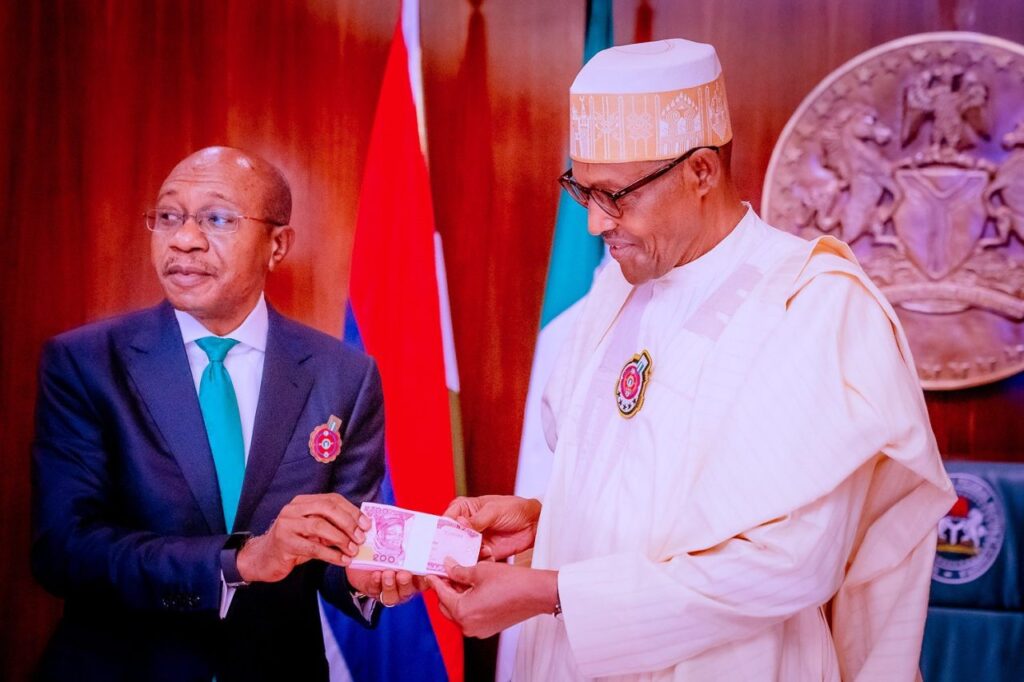

Meanwhile, on October 26, 2022 when the CBN had informed Nigerians about its plans to introduce the redesigned N200, N500 and N1,000 banknotes, the CBN governor, had made it clear that the banknotes were redesigned due to a request from the federal government. The CBN, it would seem, had no choice but to do the government’s bidding.

It is therefore clear that the CBN tried to do the best it could under the circumstance but fell short due to many issues which include inadequate timing, elite-resistance and sabotage!

Emefiele had disclosed that the new notes would begin circulation from December 15, 2022, while the old banknotes would remain legal tender and circulate together until 31 January 2023. The old notes were to cease to be legal tender on 31 January. This meant that the timing was extremely short and had all the trappings of the Buhari currency change in 1984. Talk about thunder striking twice in the same spot.

The last time the Central Bank redesigned the naira was in 2014 when it changed the design of the 100 naira note to commemorate Nigeria’s centenary. It was seamless and without incidence.

The CBN governor had said that the CBN’s objectives of the Naira redesign policy include reducing the huge amount of Naira notes in circulation outside the banking system, increasing the supply of clean notes, making monetary policy facilitate a more effective and efficient economy as well as to curtail counterfeiting of the Naira.

Other objectives include deepening the cashless policy and supporting the security forces in fighting kidnapping and terrorism, which have been blossoming for years due to ransom-taking and forced levies across parts of the country.

The CBN also said that the Naira Redesign and cashless policy would potentially promote transparency and accountability, plug fiscal leakages in MDAs and thus boost government revenues. It would facilitate the economic empowerment of vulnerable Nigerians and reposition the country for rapid growth.

But then, change is usually a difficult thing to manage and execute. Timing is also always usually critical. Around the world, the COVID-19 pandemic reinforced the value of digital payments in keeping economies running, many governments strongly discouraged the use of cash, favoring digital transactions instead.

These are high-value goals worthy of the support, understanding and even sacrifice of citizens but Nigeria’s political, bureaucratic and privileged elite would have none of it. It had been alleged by the CBN that a lot of the privileged political actors and well-placed elite were the first set of beneficiaries to receive the new notes in tens, even hundreds of millions of the redesigned naira notes from various banks where they have major affiliations and relationships against CBN directives.

Such intense mopping up meant that there was not enough cash for the generality of citizens. Despite a presidential pledge to fish out and punish the perpetrators, there has been no news or prosecution of these alleged economic saboteurs.

I dare say that unless a fool-proof system of monitoring is put in place with immediate sanctions imposed on offending banks, customers and staff, the bulk of the Redesigned Naira notes that will be released now and in the future would still end up in the homes and offices of the privileged political and elite class as they attempt to restock their depleted cash reserves. It is an open secret that transparent financial transactions are anathema to many in this class as their sources of income cannot be easily divulged.

Recall how the leadership of the political class rose to fight for the extension of the validity of the old Naira notes. Only the very gullible would believe that they did it for the love of the ‘suffering masses’. Unfortunately, Buhari’s espoused objective of using the Naira Redesign policy failed spectacularly when at the last minute both the old and new Naira notes were amply deployed to buy votes, buy officials as well as pay and deploy thugs during the 2023 elections.

Emefiele was the proxy ‘enemy’ the politicians used in their campaigns while fighting to rescind the currency issues at the Supreme Court but ultimately, it was clear to the discerning that they (the politicians) had to play politics the way they had always known, and as such the huge stash of old and new naira notes they had kept aside for the elections had to be deployed towards their desperate and selfish goals.

In Lagos, the rule of the agberos is still in force. Their presence is ubiquitous not only in the parks but all over the state. This ‘industry’ rakes in humungous amounts in billions of naira monthly and collection is done in cash. The distribution and utilization of these undeclared revenues are usually so eye-watering that those in vantage positions kill to remain there. No doubt, these guys enjoy political protection and patronage for their “deliveries” and a cashless transportation system will ‘spoil business’ for them. This is true of most states in Nigeria.

CBN needs to work with stakeholders to find a cashless solution for transporters and commuters. This takes a large chunk of people’s disposable income in Nigeria’s fractured transportation system.

The CBN’s Naira Redesign programme as well as the attempt to expand the implementation of the cashless policy programme, which began in 2012, have been viciously criticized by a section of Nigerians, some of whom as stated above have thinly disguised vested interests, however, there are enormous benefits of the policies that require Nigerians to stop the bashing and start the clapping.

First, kidnapping was reduced drastically as there was no cash to pay ransoms and secondly, a huge number of Nigerians have already adopted one or several online payment options leading to an exponential increase in cashless payments. This will ultimately promote efficiency and catalyze growth.

CBN must however reach out to banks and critical stakeholders in the payments and online banking ecosystem to quickly upscale their infrastructure (hardware and software) to accommodate the expected influx of fresh financial service tech adopters and the torrents of transactions that the effort has so far thrust unto their platforms to provide stable and reliable service as against crisis they found themselves in February and early March.

The CBN should also further engage and begin to enforce regulation of Point-of-Sale (POS) operators who reportedly took undue advantage of hapless Nigerians in the heat of the cash crunch crisis.

Consultations and communications with critical stakeholders are key to the eventual success of the CBN’s overall policy thrusts.

It is important to note that the CBN, under Emefiele, has made a suite of interventions in the financial system and the economy that have had immense benefits for the country and businesses as well as mitigated the damaging effects of several waves of the global economic recession especially that caused by the COVID-19 pandemic.

In the end, Nigerians must understand that the Naira Redesign policy and the cashless policy are more about the good of Nigeria and its citizens and less about the individual ambitions and motivations of the CBN Governor, Godwin Emefiele. Now that we have more time, let’s join hands and make Nigeria work better for us.