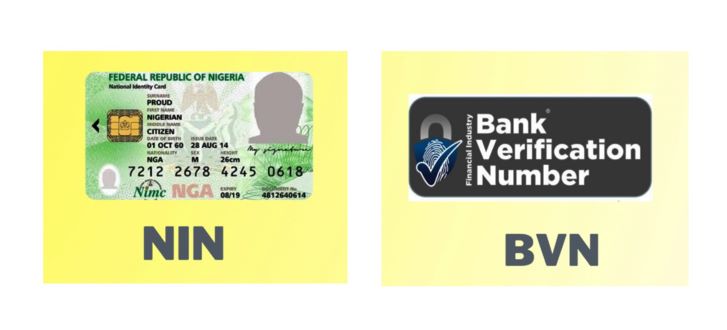

Customers of various banks in the Federal Capital Territory have thronged their banks to link their National Identity Number (NIN) and Bank Verification Number (BVN) to their accounts.

Customers of various banks in the Federal Capital Territory have thronged their banks to link their National Identity Number (NIN) and Bank Verification Number (BVN) to their accounts.

BRANDPOWER recalls that banks have mandated customers to link their BVN-NIN to their accounts giving March 1 as deadline for the linkage.

A NAN correspondent, who monitored some banks in the FCT on Wednesday, reports that customers were seen submitting photocopies of their NIN slip with their account details written on it.

At Guaranty Trust Bank (GTB), Stanbic IBTC, Area 3 and Access Bank in Nyanya-Jikwoyi road, customers interviewed told NAN that though their accounts were still active, they decided to visit the banks for the update.

Mr William Achimogo, a customer of GTB and a civil servant, said that he visited the bank to link his BVN-NIN to his account to avoid his account being blocked.

“I came to the bank to link my BVN-NIN because of the deadline they gave.

“It is my salary account and I will not want anything to affect the account so that my salary will not be withheld.

“Although, this is tasking and stressful to me but I just decided to do it so that I won’t fall into problems,’’ he said.

Similarly, a customer at Stanbic IBTC, Mrs Aina Yakubu, said that in spite of the March 1 deadline for the linkage, her account was still active.

Another customer, Mr Williams Ikeh, who banks with First Bank Plc, said that the announcement had caused customers to rush to their banks, thereby, making it difficult for people doing other transactions.

Meanwhile, an official of Stanbic IBTC who preferred anonymity said the account of customers yet to link their BVN-NIN would be restricted after some grace period.

Another official at First Bank Plc, said that although customers were visiting the bank to link their BVN-NIN, the BVN linkage was more important.

“As long as a customer’s BVN is already linked to his or her account, there won’t be any concern,’’ he said.

This development follows a circular issued by the Central Bank of Nigeria (CBN) in 2023, mandating existing customers to complete the full profiling of accounts established through agents within the Nigeria Inter-Bank Settlement System.

The circular stipulated that all funded accounts or wallets must be placed on “Post No Debit or Credit” status, with no further transactions permitted until compliance is achieved.