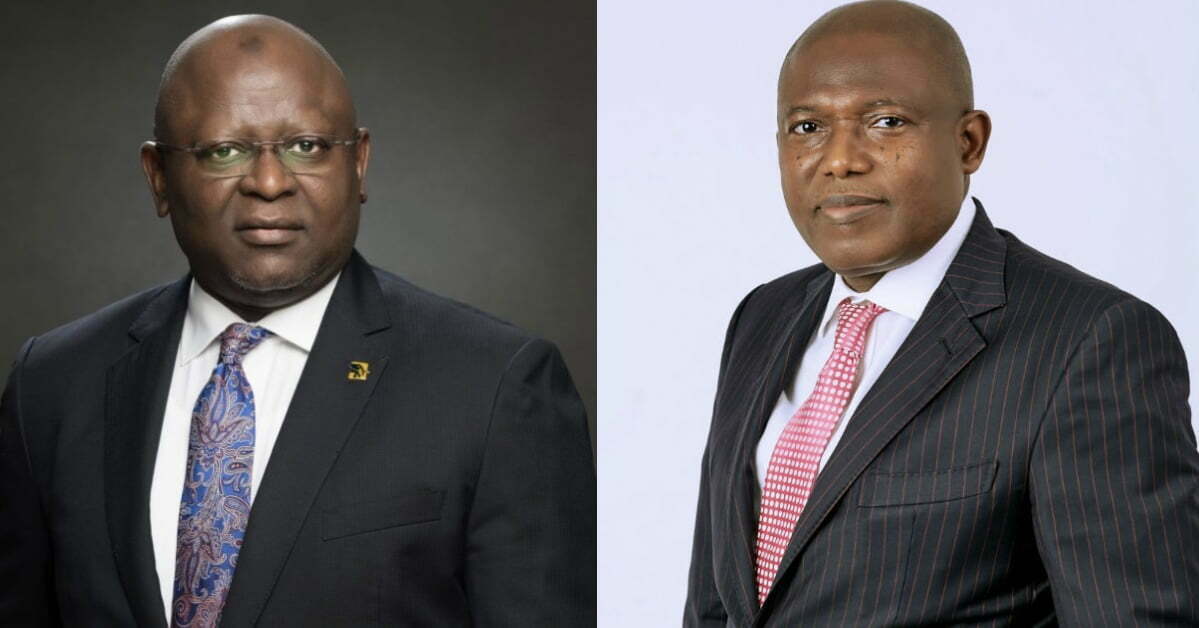

The CEOs of First Bank of Nigeria, Adesola Adeduntan and Bank of Industry, Olukayode Pitan, have affirmed that Nigeria is the most attractive destination for investment in Africa. They made the declaration in their respective contributions at a Nigeria International Partnership Forum in Paris.

This is, among other reasons due, to Nigeria’s teeming population of over 200 million people and its access to markets across the continent.

Presenting a paper at the forum, Mr Adeduntan said with the coming into effect of the African Continental Free Trade Agreement, investing in Nigeria would give access to markets across Africa.

He said with a GDP of about $500 billion and the projection that the Nigerian population would grow from more than 200 million to 450 million people by 2050, the country was an investors’ haven.

Besides, the banker said there was an abundance of natural resources, hydrocarbon, and other solid minerals deposits in Nigeria.

“Last year, Nigeria recorded the best stock exchange in terms of performance. Lagos, the commercial nerve centre of Nigeria, was ranked as the best city for technology starts up of the continent, boasting of three of the world-known telecoms in the continent,” added the bank CEO. “Nigeria also attracted about 39 per cent of the venture capital investments that came to the continent in 2020.”

Mr Adeduntan further explained that Nigeria had recorded significant growth in the Ease of Doing Business, with potential investment in the ICT sector.

He added that the government had created some financial institutions that are essentially geared towards providing long-term financing to aid foreign and indigenous investors.

The institutions, according to him, include the Bank of Agriculture, Bank of Industry, Development Bank of Nigeria, and the Central Bank of Nigeria.

Speaking in the same vein, Pitan, the BoI boss, said on average, Africa imported about $594 billion worth of goods and $152 billion in services.

Breaking it down, he said African countries imported about $138 billion of refined petroleum products, $1.7 billion of crude oil, and $18 billion of plastics. He added that $28 billion of iron and steel, $12 billion of textile, $6.9 billion of sugar, $6.7 billion of rice, and $5.7 billion of rubber and oil palm.

The banker said Nigeria, being the biggest market in Africa, any smart businessman should look at any of the areas to invest, using Nigeria as the base.

“The BOI is the oldest policy bank with 52 years experience, and it is there to support investors who are ready to establish in the country,” he said.

(NAN)